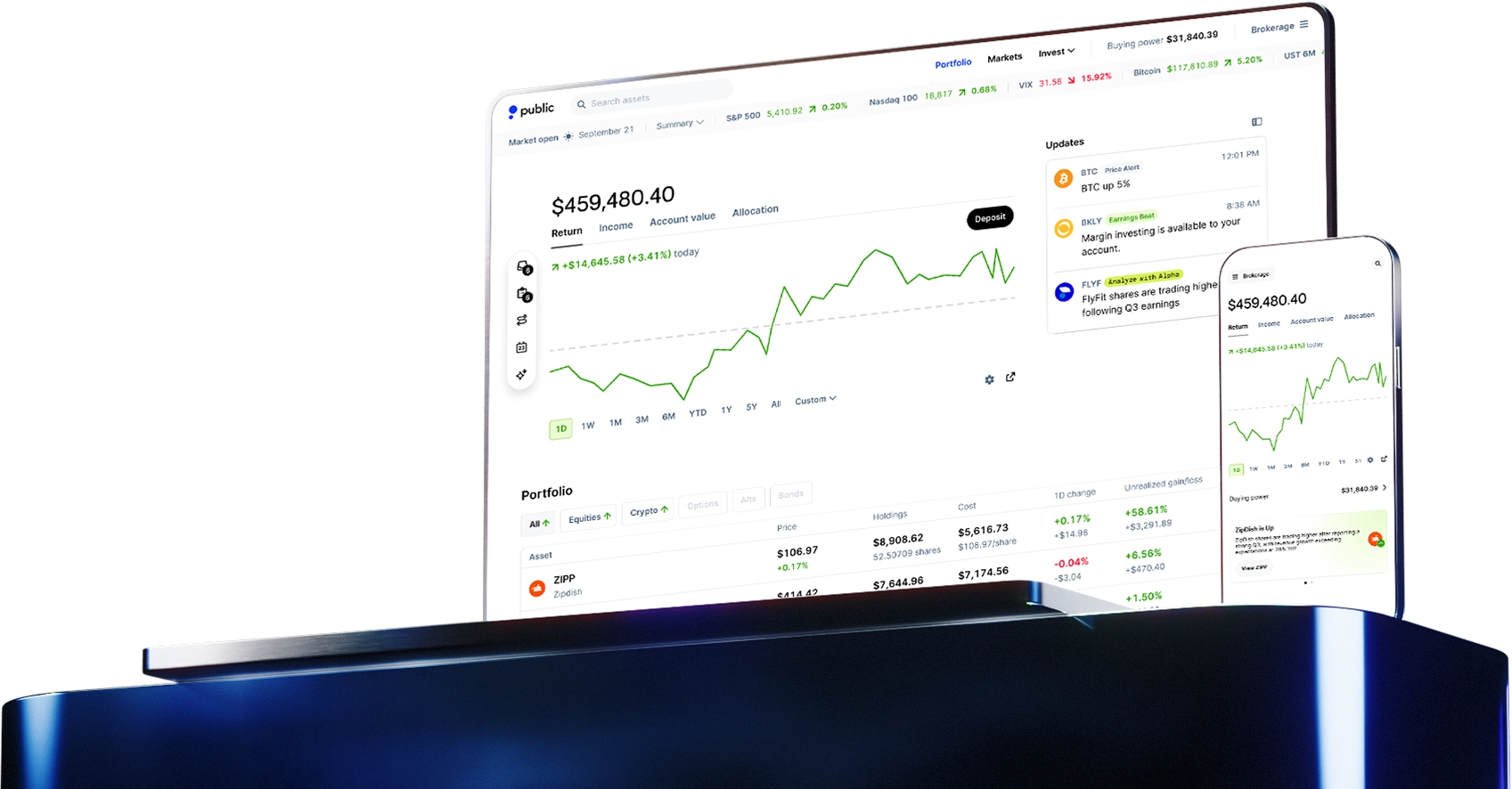

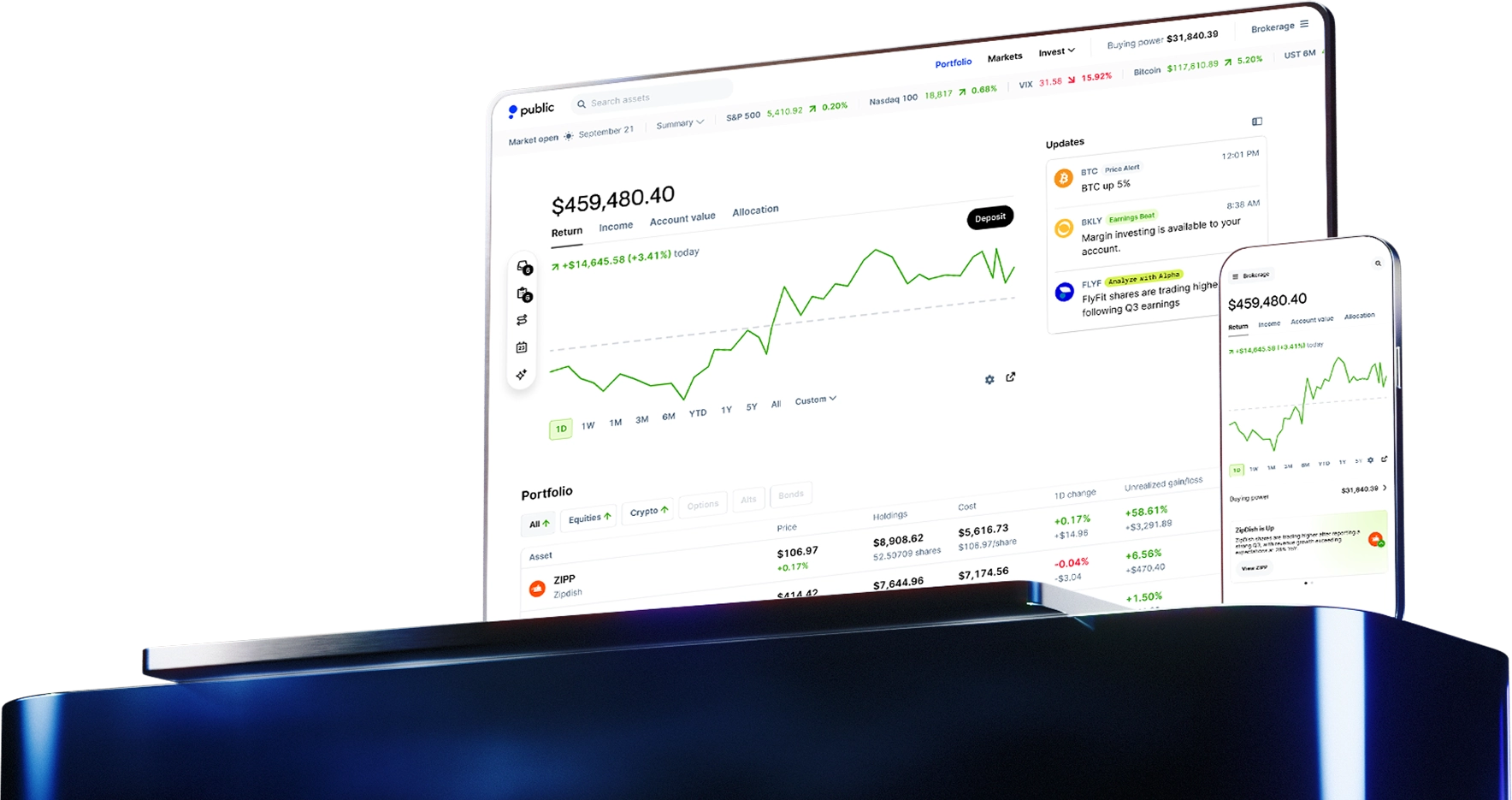

Invest in stocks

Build your portfolio with access to over 9,000 equities, and get the market insights you need to execute your investing strategies.

Sign UpExplore Stocks

Investing tools

Access powerful investing tools

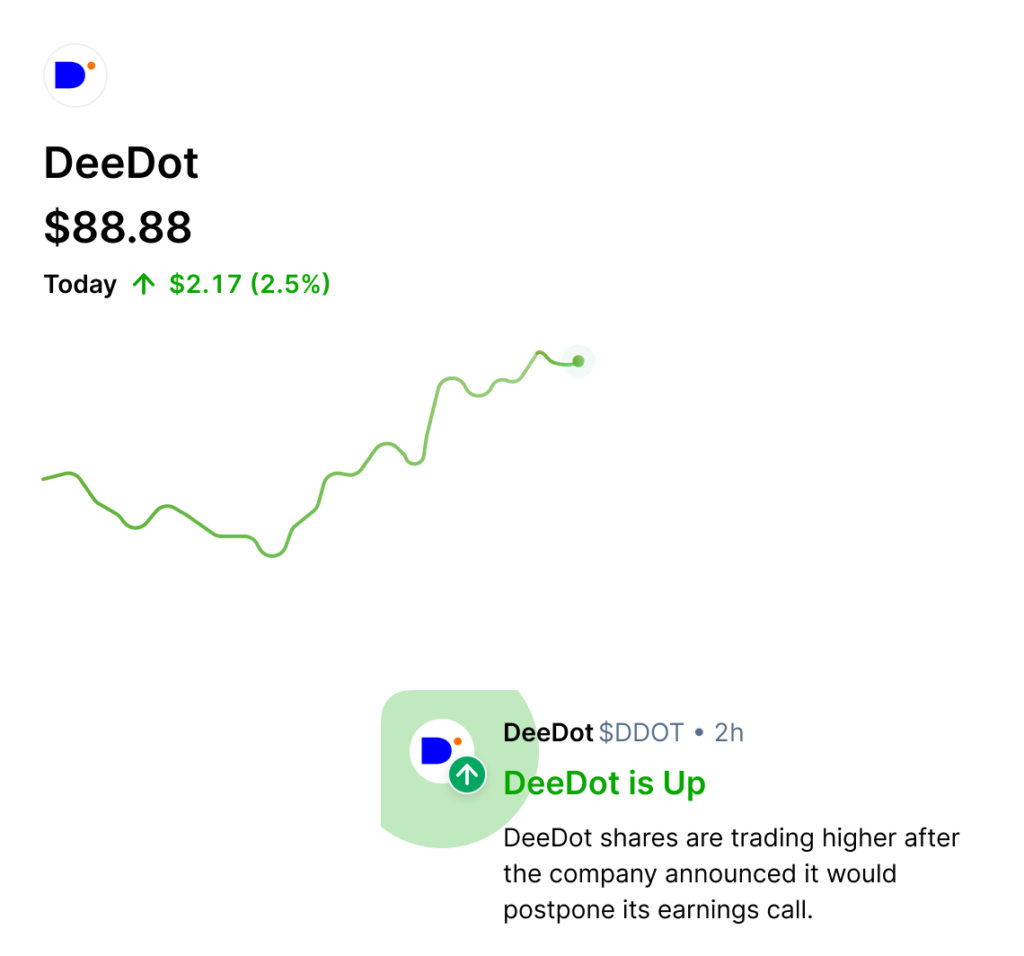

Set price alerts for stocks

Make timely investment decisions with price alerts for all the stocks you care about. Get notified when an asset falls above or below your set threshold.

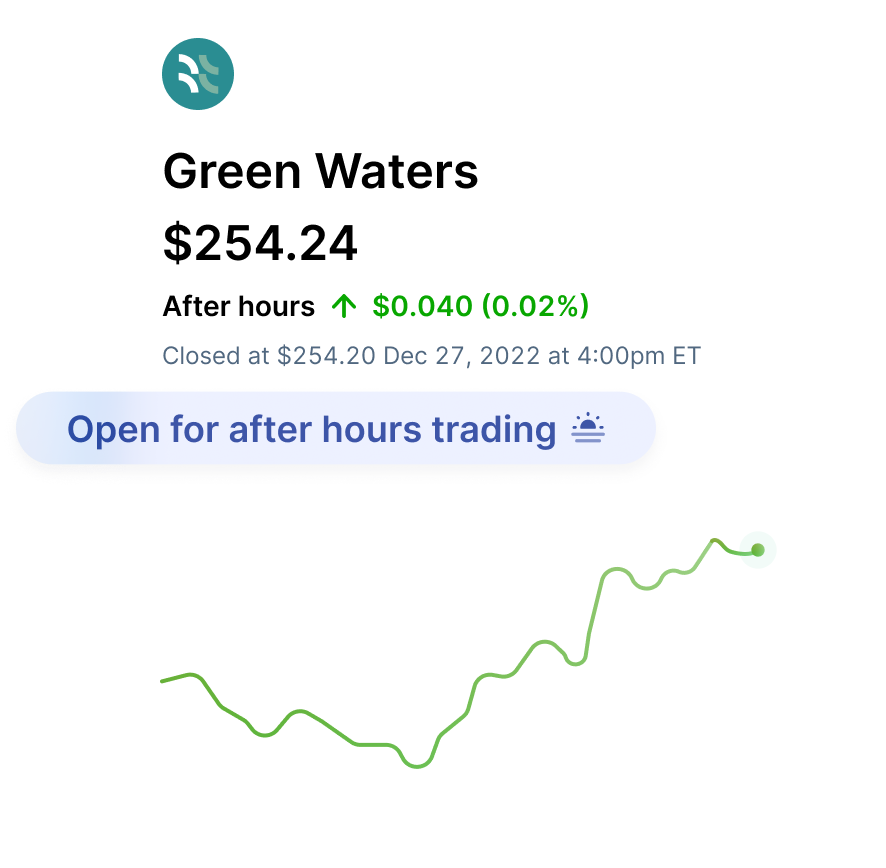

Get more time to react to market events

With extended-hours trading, you get over 5 additional hours to buy and sell stocks. Access pre-market trading from 8 AM to 9:30 AM ET and after-hours trading from 4 PM to 8 PM ET.

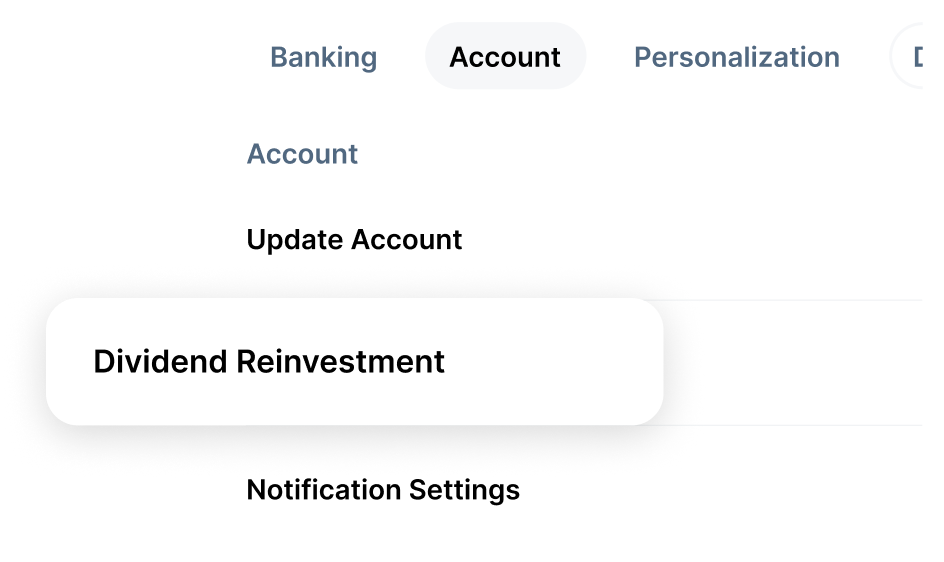

Automatically reinvest your dividends

If you have dividend stocks in your portfolio, you can automatically reinvest your proceeds from the asset right back into the company that paid them out.

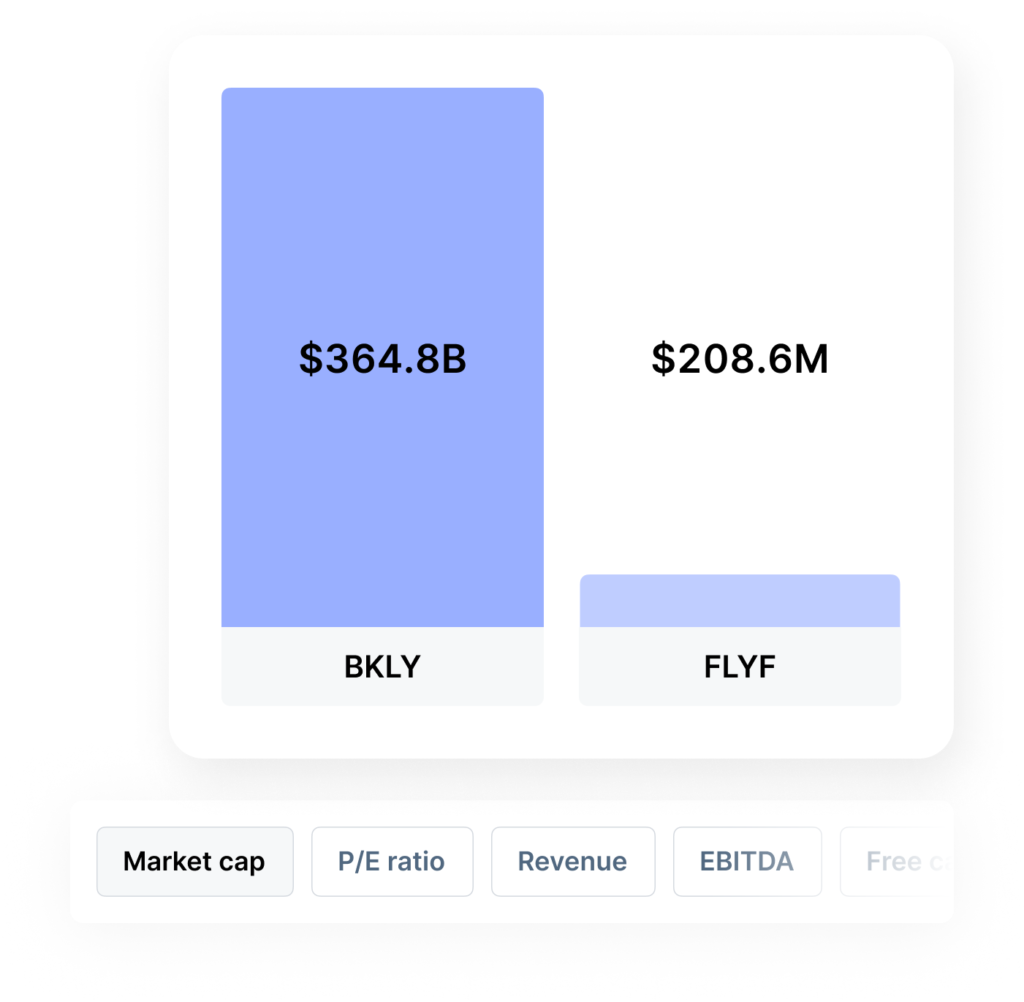

Compare stocks side by side

Power your stock analysis with Compare—our new stock comparison tool that makes it easy to analyze the fundamentals side by side.

Market insights

Make informed investment decisions

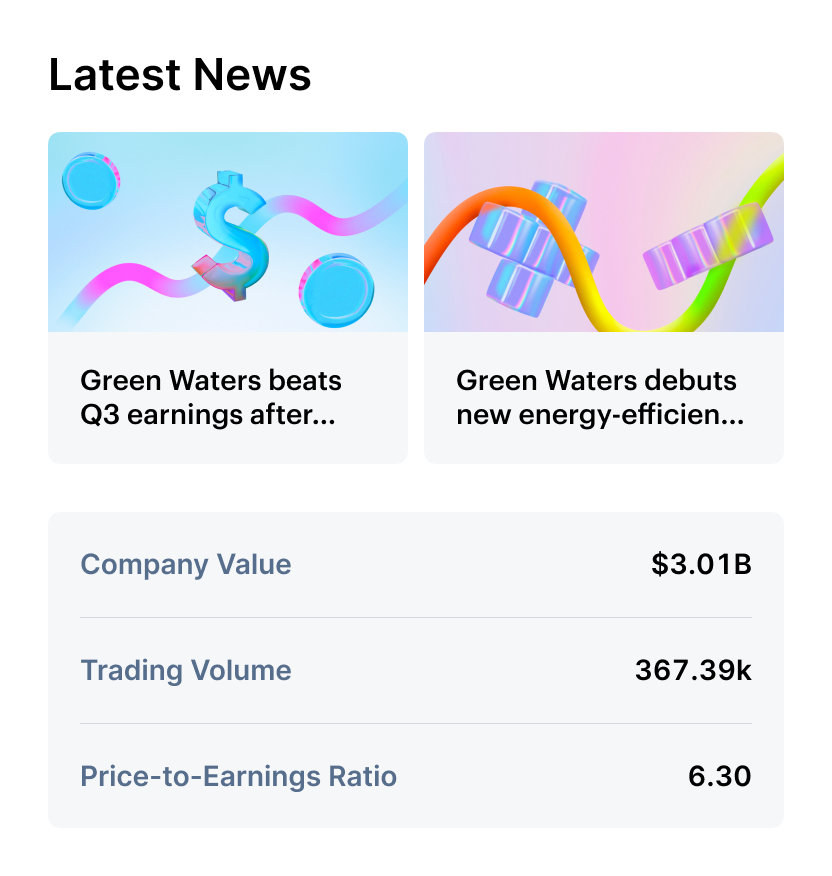

Take a closer look at any stock

Every stock page on Public has helpful information about the company and its performance, including key metrics, news, and recent activity from other investors.

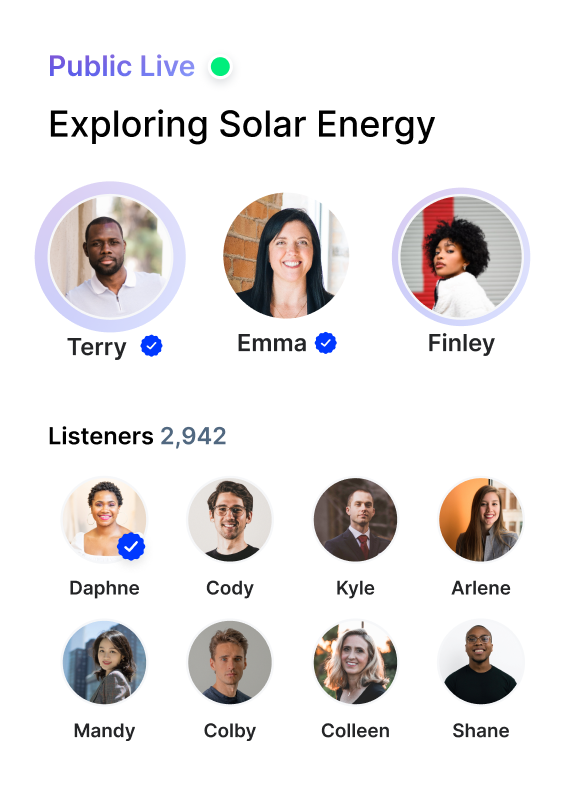

Get daily live analysis on the markets

Each day, you can hear experts, analysts, and journalists discuss the day’s biggest market headlines—and what they mean for your portfolio—on Public Live.

Upgrade your portfolio

With Public Premium, you can unlock advanced data and company-specific analysis to help inform your stock-trading strategies even further.

OTC stocks

Trade select OTC stocks

Over 300 select over-the-counter (OTC) stocks are available on Public, focusing predominantly on large-cap international companies.

- Available OTC offerings focus predominantly on large-cap international companies

- Over 300 select OTC stocks are now available

- Stock pages include additional research, data, and analysis

- Additional companies will be added over time

Have questions? Find answers.

Are there fees to buy or sell stocks on Public?

At Public, stock and ETF trades are commission-free, meaning $0 commission trading on self-directed individual cash brokerage accounts that trade U.S. listed securities placed online. Other fees, like regulatory fees, subscription fees, wire transfer fees, and paper statement fees may apply. Review our Fee Schedule to learn more.

Have additional questions about investing in stocks with Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Build your portfolio with Public